As U.S. President Donald Trump escalates his trade war with a staggering 145% tariff on Chinese imports—potentially reaching 245% on specific goods—India stands at a pivotal crossroads. The global trade landscape is shifting, and New Delhi has a rare opportunity to capitalize on the chaos, provided it navigates the challenges with strategic precision. From India’s perspective, Trump’s tariff blitz, while disruptive, could be a catalyst for economic growth, but only if the nation acts swiftly to address its structural limitations.

The U.S.-China trade conflict, intensified by reciprocal duties (China’s retaliation stands at 125% on U.S. goods), has created a vacuum in global supply chains. Companies like Apple are already pivoting, with India emerging as a key beneficiary.

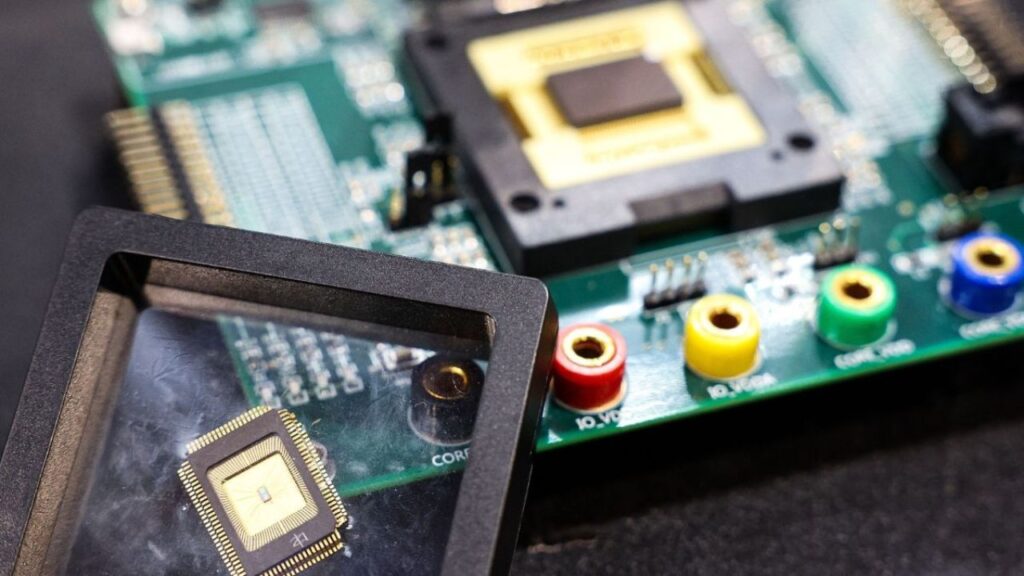

In March 2025, Apple airlifted $2 billion worth of iPhones from India to the U.S., preempting tariff hikes, and now assembles all iPhone models locally, including premium variants. India’s share of Apple’s global iPhone production could soon hit 30%, a testament to its growing industrial capacity.

With China facing punitive tariffs, India’s relatively lower 26% tariff rate—compared to China’s 145% or Vietnam’s 46%—offers a competitive edge for textiles, electronics, and pharmaceuticals. This “tariff arbitrage” could attract multinationals seeking alternatives to Chinese manufacturing.

Yet, India’s optimism must be tempered by realism. Trump’s tariffs, while less severe for India than for others, still pose risks. The 26% duty on Indian goods, effective April 9, 2025, threatens sectors like gems, jewelry, and auto parts, which rely heavily on U.S. markets.

Economists estimate these tariffs could shave 0.5 percentage points off India’s GDP growth if global trade patterns shift unfavorably. Moreover, Trump’s rhetoric branding India a “tariff king” signals potential for further escalation if New Delhi doesn’t reciprocate with concessions. India’s high average tariff rate of 12%, compared to the U.S.’s pre-tariff 2.2%, fuels Washington’s frustration, as does India’s non-tariff barriers like strict import rules and data localization mandates.

India’s response has been measured but proactive. Prime Minister Narendra Modi’s administration has avoided retaliatory tariffs, instead pursuing a bilateral trade agreement with the U.S., aiming for $500 billion in trade by 2030. Concessions like reduced duties on U.S. motorcycles and whiskey signal India’s willingness to negotiate, but opening protected sectors like agriculture remains a political minefield. The 2020 farm reform protests serve as a stark reminder of domestic sensitivities. Meanwhile, China’s overtures—urging India to resist “U.S. tariff abuse”—are unlikely to sway New Delhi, given the $100-billion trade deficit and lingering border tensions.

To seize this moment, India must address its internal bottlenecks. Manufacturers face a shortage of skilled workers, complex red tape, and inadequate infrastructure, all of which hinder scalability. Apple’s request to cut customs clearance times at Chennai Airport from 30 to 6 hours underscores the urgency of streamlining logistics. The government’s production-linked incentives are a step in the right direction, but deeper reforms—labor market flexibility, land acquisition simplification, and port modernization—are critical to compete with Southeast Asian rivals like Vietnam.

Trump’s tariffs, while a gamble for the global economy, have inadvertently handed India a strategic opening. By leveraging its diplomatic restraint, robust domestic demand, and growing manufacturing base, India can position itself as a viable alternative to China. But the window is narrow. New Delhi must act decisively to reform its economy and secure trade deals, lest it miss this chance to reshape its role in global trade. The world is watching, and India cannot afford to blink.