The data centre market across the world is seeing a big transition led by the Artificial Intelligence led demand. AI is changing the entire use case and demand landscape for compute capacities, leading to an exponential growth in the infrastructure development in the space. According to a recent report by McKinsey, a big portion of growing demand in the data centres – about 70 percent, is dedicated to infra capable of hosting advanced-AI workloads.

India too is seeing a surge in data centre capacities because of the AI demand. The Indian data centre industry’s capacity is set to more than double to 2-2.3 GW by fiscal 2027, said a recent report by CRISIL. As of March 2024, the data centre capacity in India stood at ~ 950 MW.

Industry leaders point towards the AI boom for this increased demand. Amit Luthra, Managing Director, Infrastructure Solutions Group (ISG), Lenovo believes that with the advent of AI and advancements in technology, organizations are now tasked with processing vast amounts of data across highly distributed environments, often in real time, leading to an increased demand for computer infrastructure.

“AI is fundamentally reshaping how we think about data centre architecture. With the rapid advancement of 5G and AI-driven applications, there is an increasing demand for infrastructure that is not only robust but also scalable, resilient, and cost-effective,” he said.

He further said that as AI adoption accelerates – primarily driven by cloud service providers running complex, multi-billion parameter models – businesses are increasingly looking for infrastructure that can handle these advanced workloads efficiently and sustainably.

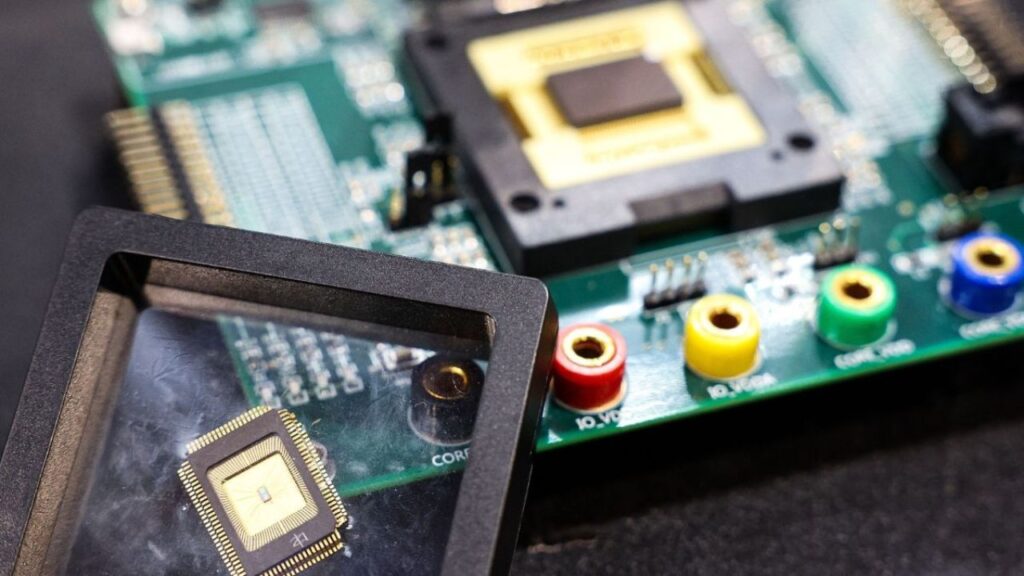

The deployment of AI tools in almost every sector requires huge compute capacity, which is forcing the traditional CPU-based data centre players to procure advanced GPU chips.

Further, startups like Hiranandani group backed Yotta Data have been quick to grab the opportunity. Yotta has already invested $1 billion to procure more than 32,000 Nvidia GPUs to scale its compute offerings in the country. Additionally, existing players like CtrlS datacenters, NTT data have made similar commitments.

The attractiveness and demand in India’s data centre market is evident in the fact that global hyperscalers including Google, Amazon, and Meta, among others, are rushing to cash on the opportunity. A report from JLL Research found that 50 percent of user demand for data centers in India came from hyperscalers in 2023.

In a data centre market which is expected to attract investments worth $5.6 billion by 2026, according to the JLL report, also underlined that hyperscalers were increasingly considering India as a viable market.

“Long term investment plans by hyperscale for self-build facilities highlight that India can be a reliable DC hub for the world,” said the report.

The rapid growth story of the DC market in India is also reflected in terms of the expansion of capacity area-wise. According to technology industry body Nasscom, data centers in India witnessed significant growth between 2017 to 2022, with total capacity growing four-fold from 2.7 mn sq ft to 10.3 mn sq ft within five years.

Policy initiatives like the Startup India Programme and India AI mission have provided an impetus to the sector, experts believe. Centre in 2023 launched the India AI Mission worth Rs. 10,372 crore, part of which aims to develop GPU compute capacity in India. Further, STPI – an autonomous body under the Ministry of Electronics and Information Technology (MeitY), has been long supporting data parks and similar infrastructures under its various programmes.

But the question of what’s driving the data centre demand in India has its answer primarily in two factors – post covid change in businesses adapting online solutions, and the scaling of high speed internet and 5G technologies, according to reports.

Data centre demand also has a direct correlation with mobile data traffic which has logged a compound annual growth rate (CAGR) of 25 per cent over the last five fiscals. It stood at 24 GB per month at end-fiscal 2024 and is expected to rise to 33-35 GB by fiscal 2026, according to estimates.

The future of any industry is determined by its present performance and its growth opportunities. Both of these indicators point towards a strong future of India’s data centre industry, which has already become a leader in the Asia-Pacific (excluding China), having overtaken Singapore, Australia, South Korea, Japan and Hong Kong on installed capacity.

India’s DC industry secured investment commitments of more than $40 billion from both global and domestic investors, between 2018 and 2023. Most of this was aimed at metro cities, but now it is expected to expand to tier-2, tier-3 cities, as the demand increases ahead.

But not everything is okay with the evolving ecosystem of cloud in India. Many reports point out various energy challenges that come attached with the sector that needs a lot of power in the first place. That is primarily one of the reasons why the government is thinking of creating separate transmission lines for data centres in the country.

According to a report in The Economic Times, the union government is exploring the feasibility of providing dedicated, uninterrupted power to large data centre parks either through direct lines from power producers or by setting up small nuclear plants nearby.

Apart from the power needs, another issue that the industry faces is water shortage in major cities in India. Water is required in huge quantities for data centre operations, where it is used as a coolant, because of the large amounts of heat generated by the servers.

Now, most of the installed capacity of servers in India is located in megacities, which are already struggling with water, which is a looming threat for the sector going forward, experts say.

According to various estimates, a 1 MW data centre that reduces air temperature by cooling water can use around 25.5 million litres of water per year, or 68,500 litres a day, which would mean that a 20 MW data centre would need about 1.37 million litres a day if it uses a water-intensive cooling solution.

Whereas on the other side, daily water supply is just over 1,000 million litres in Chennai, about 1,500 million litres in Bengaluru and close to 3,000 million litres in Mumbai, with demand pegged much higher, an economic times report indicated.

The problem of water shortage is real and industry needs to devise innovative solutions to deal with the problem. One solution to this, that many large players like Equinix have already started to adopt, is to deploy air cooling instead of using water as a coolant.

Further, to cut down on the use of water and power for cooling and increase efficiency, companies globally are exploring different technologies, such as liquid immersion cooling. Under this the server is put in a tank filled with a dielectric coolant (which does not conduct electricity) that absorbs and dissipates the heat generated. The method is increasingly being adopted by giants like the Hewlett Packard Enterprises (HPE) to provide more sustainable solutions in India.

Experts, for the reason of lack of resources, also argue for moving the data centres to beyond the Metro cities, and in places where resources such as power, land, and water are available easily and at affordable cost. This is important, because only when data centre operating costs in India remain cost effective, it will be an attractive business model for global and Indian players, like any other industry which is at a strong growth and transition phase.

Supported by factors such as demand, availability of talent, and low construction costs, the data centre industry is surely oriented towards continuous growth for now, as indicated by experts and industry bodies.

Further, India’s growing startup and tech ecosystem, also provides for an ample opportunity for data centre infrastructure providers to invest and reap in the benefits for years to come.