When Donald Trump reclaimed the White House in January this year, he launched an aggressive trade policy dubbed “Economic Independence Day,” imposing tariffs of 10% on all imports, with rates spiking to 50% on nations like India and Brazil.

The goal was to shield American workers, shrink trade deficits, and spark a manufacturing renaissance. Nine months later, by September, the results are dire: skyrocketing prices, slumping consumer confidence, and a faltering economy.

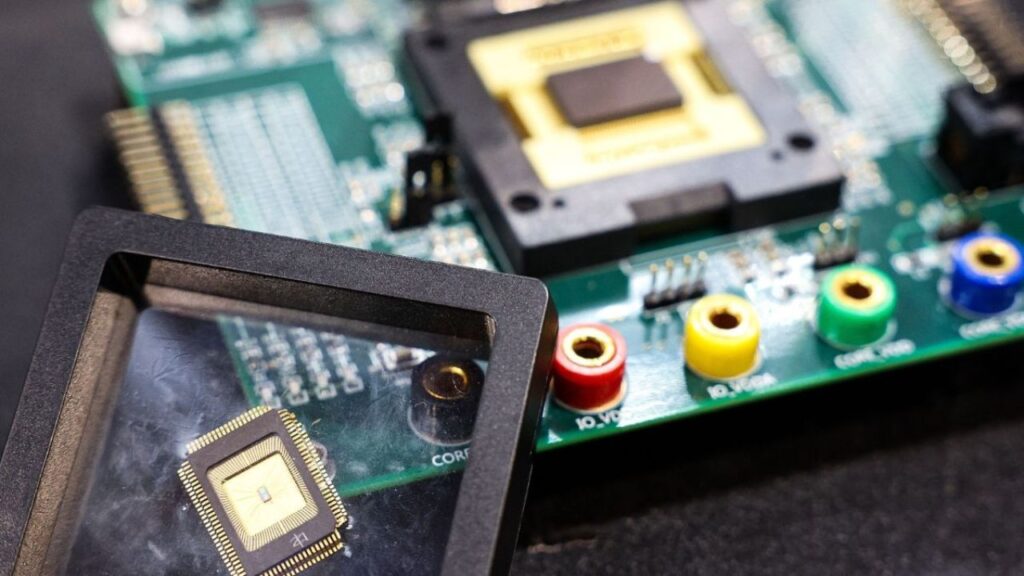

The Tax Foundation estimates these tariffs cost U.S. households $1,300 annually, inflating prices for essentials like clothing, electronics, and food by up to 17%. Consumer spending has cratered, contributing to a revised GDP forecast of 1.4% for Q4 2025, down from 2.1% earlier projections, as per J.P. Morgan analysts.

The anticipated manufacturing boom has fizzled. Supply chain chaos and retaliatory tariffs have led to 320,000 job losses in import-reliant sectors, with unemployment projected to hit 4.7% by December, according to the Congressional Budget Office.

Companies like Harley-Davidson have scrapped financial forecasts due to sourcing disruptions, while Stellantis laid off 900 workers in April, citing tariff-related parts shortages. American farmers, especially soyabean and pork sellers, face renewed bankruptcy risks as China’s heavy retaliatory duties devastate agricultural exports.

As America’s economy stumbles, China has seized the moment to expand its global influence. The Shanghai Cooperation Organisation (SCO) Summit in Tianjin, held August 31 to September 1, showcased Beijing’s ambition. Hosted at the revamped Meijiang Convention Center, the summit drew over 20 leaders, including Russia’s Vladimir Putin, India’s Narendra Modi, and Turkey’s Recep Tayyip Erdoğan—the largest SCO gathering ever.

President Xi Jinping announced ¥2 billion in grants, ¥10 billion in loans, and an SCO Development Bank to boost intra-bloc trade with yuan-based bonds. The Tianjin Declaration condemned “unilateral bullying,” a swipe at U.S. policies, and outlined a 2035 Development Strategy for Belt and Road expansion, green energy, and de-dollarization via local-currency trade.

The SCO, representing 42% of the world’s population and 36% of global GDP (PPP), is positioning itself as a rival to Western institutions. China has redirected exports hit by U.S. tariffs to SCO markets, increasing trade with Central Asia and Southeast Asia by 20%. Its “Electro Yuan” initiative, tying renewable energy to yuan financing, has funded 160+ projects worth ¥380 billion, cementing Beijing’s soft power.

Trump’s isolationist stance has estranged allies, pushing non-Western nations toward China. The EU faces a 0.3% GDP hit from diverted Chinese exports, straining its industries. A fragile U.S.-China tariff truce, extended to November 10 after September 14 talks in Madrid, staves off holiday-season disruptions but teeters as Trump threatens 100% duties tied to Ukraine tensions.

A separate Madrid deal on TikTok allows U.S. ownership to keep the app running past September 17, reflecting uneasy pragmatism. The IMF now forecasts global growth at 3% for 2025, blaming tariff uncertainty.

On September 13, Trump urged NATO and EU allies to slap 100% tariffs on China and India to pressure Russia over Ukraine, risking transatlantic fractures. Treasury Secretary Scott Bessent claims tariffs have raised $300 billion for debt reduction, but critics argue this masks deeper fiscal strain. The Supreme Court’s decision on September 9 to fast-track a case on the tariffs’ legality under the International Emergency Economic Powers Act, with arguments set for November, adds further uncertainty.

The administration’s rhetoric has worsened the fallout. On September 1, White House trade adviser Peter Navarro, in a Fox News interview, accused Indian refiners of acting as a “laundromat for the Kremlin” by buying discounted Russian oil and claimed India’s “Brahmins” were profiteering at their people’s expense to justify 50% tariffs on Indian imports.

Meant to target economic elites, the term “Brahmin” was slammed as casteist, sparking outrage. BJP called it “culturally obtuse”. The gaffe, coinciding with Modi’s Tianjin meeting with Xi—where they vowed to deepen trade ties and secure tariff-free Chinese market access—has strained the Quad alliance and nudged India toward Beijing.

The Global South increasingly views Beijing as a stable partner, with nations like Brazil and South Africa joining SCO trade frameworks. The world expected a resurgent America, but Trump’s tariffs and diplomatic missteps have hastened its retreat. China is not just filling the void—it’s building a multipolar order rooted in Asian ambition and pragmatic realpolitik. With the dollar’s dominance waning and alliances shifting, the fallout from these policies will reshape global dynamics for decades.